As we enter the second quarter, headlines are dominated by tariffs and the market’s reaction, following on from an active first quarter for the private markets.

The private markets kicked off 2025 with a surge of activity, particularly in tech, despite a backdrop of volatility and shifting risk sentiment. In the quarter, we witnessed CoreWeave complete the biggest tech IPO since 2021, OpenAI close the largest private tech fundraise in history – nearly triple the previous record, and xAI finalize its acquisition of X (formerly Twitter). Meanwhile, deals like Wiz and Datastax being acquired, and Anthropic’s headline-grabbing raise, have added to the sense of momentum. All of this has unfolded amid a risk-on/risk-off cycle that defined the opening stretch of the year. Yet, the market’s resilience (and investor participation) suggests that private markets are finding their footing as 2025 unfolds.

Global IPO proceeds reached USD 28.2 billion across 283 deals, according to KPMG, marking a 4% increase in funds raised compared to the same period in 2024. While the number of deals remained steady, the increase in proceeds underscores improving deal quality and investor confidence. The U.S. led the charge, accounting for approximately 30% of global IPO proceeds. In total, 53 IPOs raised USD 8.5 billion in the U.S., a notable rebound from the same period in the prior year.

The first quarter saw fifteen IPOs in the U.S. raise over USD 100 million, including three standout billion-dollar deals, of which two were tech firms:

- CoreWeave, a rapidly growing AI-focused cloud computing firm,

- Venture Global, a liquefied natural gas (LNG) producer, and

- SailPoint, a software provider that emerged from a leveraged buyout.

These transactions reflect a growing investor appetite for scaled, sector-leading companies, particularly those operating in the tech industry. The strength of AI as an investment theme continued to dominate headlines:

While macroeconomic uncertainty around tariffs and interest rates persists, investor confidence in the long-term potential of AI remains high. The accelerating adoption of AI technologies is driving market enthusiasm, helping tech companies command premium valuations and create favorable conditions compared to public markets.

– Dan Sanders, Head of Private Markets, CEO InvestX Markets LLC.

The IPO market, while not fully unlocked, continues to show promising potential, with private companies such as Klarna (albeit delayed), Circle, Gemini, Kraken, and Chime positioning to go public following the momentum generated by CoreWeave’s successful debut.

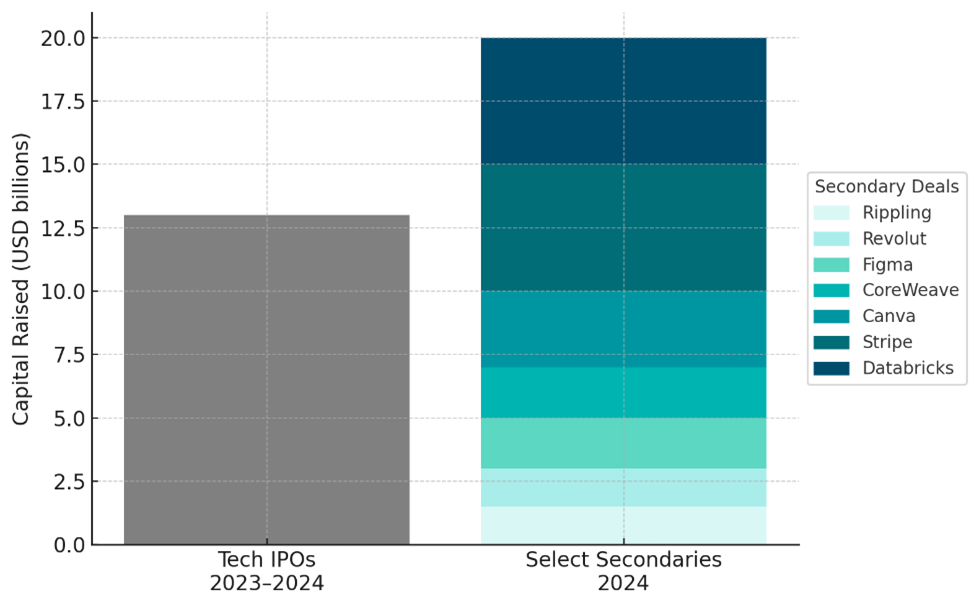

The private market’s more methodical trading process can be advantageous amid public market volatility, which continues to swing in response to day-to-day signals such as tariff developments and geopolitical headlines. Private markets tend to be more resilient but can also be susceptible to volatility as well as contending with the possibility of reduced liquidity. From March 2023 to the end of 2024, seven prominent companies (Stripe, Databricks, CoreWeave, Figma, Canva, Revolut, and Rippling) collectively raised $18.8 billion in the secondary market. The total proceeds associated with these secondary share sales eclipsed the proceeds from all tech IPOs over the same period.

Secondary Sales in 2024 Outpace Tech IPOs in 2023-2024

Another area we believe has significant future growth potential, closely linked to the advancement of AI, is robotics, which brings AI-powered hardware into real-world environments. The global market value of industrial robot installations has reached an all-time high of USD 16.5 billion. Humanoid robots, designed in the form of human bodies, have attracted substantial media attention, particularly for their potential to address ongoing labor shortages. Development in this space has accelerated rapidly in 2025. Notably, Apptronik, a Texas-based robotics company founded in 2016, announced a $350 million Series A funding round, with participation from Google. This capital will enable the company to scale production of its robots for industrial applications such as logistics and manufacturing, with potential future use cases in healthcare and home environments.

Furthermore, Apptronik competitor Figure has aggressive plans to ship 100,000 humanoid robots over the next four years and just announced that it will start alpha-testing its humanoid robot in homes this year, two years faster originally planned.

While Q1 brought some momentum to parts of the private market, the current environment still demands discipline and focus on identifying high-quality, durable opportunities that can benefit from long-term, structural trends.

Recent Posts

- Private Markets Review – Q1, 2025 14th Apr 2025

- xAI and X.com Merger: InvestX Analysis 10th Apr 2025

- xAI has acquired X: InvestX initial reaction 07th Apr 2025