Hedge Funds, Options, Futures, Exchange Traded Funds, Stocks, Bonds and Private Equity…. so many to choose from. Learn about the recent trends in how the biggest players are allocating their portfolios.

In the investing world there are so many options for investors to place their money. From directly investing in stocks, corporate bonds, treasury bonds (traditional investments) all the way to more complicated opportunities such as Exchange Traded Funds (ETF), futures, options and so on. For anyone getting started in the world of finance and investment seeing all of these options might make them feel overwhelmed and scared. Because of that and other reasons, some people prefer to go to hedge funds or mutual funds because they are ‘just as profitable’ or have a ‘higher return’ because of the hedge position. What people don’t know, is the risk that comes with those hedged positions, and the actual recent performance in the industry of hedge funds.

So, let’s see what the experts are doing and see how they are acting according to their extensive understanding, knowledge and expertise. As Bloomberg reports: “Ellen Cooper, the former Goldman Sachs Group Inc. money manager who is chief investment officer at Lincoln National Corp., plans to boost the insurer’s holdings of private equity while reducing allocations to hedge funds…By 2018, about 90 percent of its alternatives portfolio will be in private equity with the rest in hedge funds”. Lincoln National is not the only company allocating away from hedge funds; the article explains: “The insurer joins American International Group Inc. and MetLife Inc. in scaling back hedge fund holdings after disappointing results. Lincoln reported an annualized return of 4.4 percent since the first quarter of 2012 on hedge funds, compared with 12.6 percent on private equity”.

Enough with percentages – how much money are we talking about? Here’s what an article from Bloomberg has to say:

” Just this month, American International Group Inc. said it submitted redemption notices for $4.1 billion, and MetLife Inc. announced a plan to exit most of its $1.8 billion hedge fund holdings.”

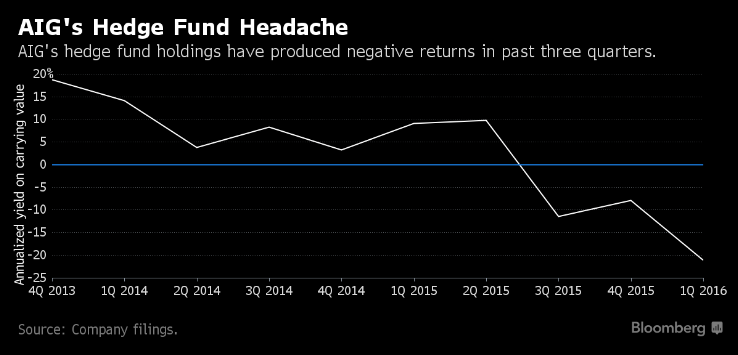

Is important to know that this decision of leaving hedge funds is not based on a trend or just to try new things. The following chart shows the performance of hedge funds for AIG:

A 2015 report on private equity by EY found that 46% of professional investors planned to increase their private equity allocations by 2017.

Recent Posts

- Private Markets Review – Q1, 2025 14th Apr 2025

- xAI and X.com Merger: InvestX Analysis 10th Apr 2025

- xAI has acquired X: InvestX initial reaction 07th Apr 2025