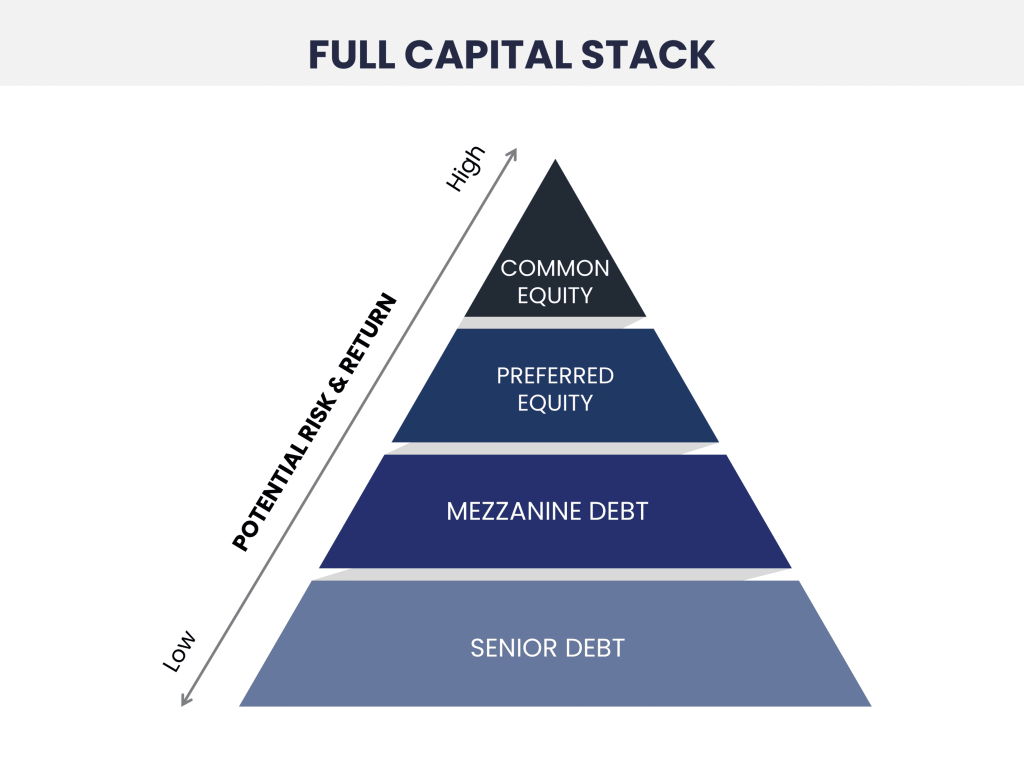

A company’s capital stack represents the hierarchy of financial sources and obligations used to fund the company’s operations and growth. The capital stack can include a mix of debt and equity; each layer has distinct risk and return profiles due to the difference in claims on a company’s assets. Capital stack risk comes into play during liquidation events that are not IPOs, where liquidation rights and preferences of preferred equity shareholders can put common shares and early preferred shareholders at an extreme disadvantage. In the event of an IPO, its usually expected that all preferred stock will convert to common stock before a company’s initial public offering (IPO). This is because the underwriters (the investment banks) managing the company’s IPO require it.

Liquidation preferences:

Preferred shares often contain liquidation rights and preferences that guarantee preferred shareholders are paid first after an exit event. There are standard and non-standard terms for the various types of rights and liquidation preferences. Standard terms are more common and friendlier to common stockholders when a company exits, while non-standard terms are less common and give preferred investors additional protection against company’s downside exit scenarios.

Preferred shareholders are either participating or non-participating. Participating shareholders on exit receive their capital contributions and then share any remaining profits alongside the ordinary (common) shareholders typically on a pro-rata basis. Non-participating shareholder only receive the greater of their capital contributed or the amount if their shares were converted to common.

A standard approach to a liquidity preference is known as pari-passu preference. All preferred shareholders have equal rank, and available funds are distributed equally according to each investor’s percentage of the overall investment. This is opposed to “stacked preferences,” in which later investors receive preference over earlier investors in liquidity events.

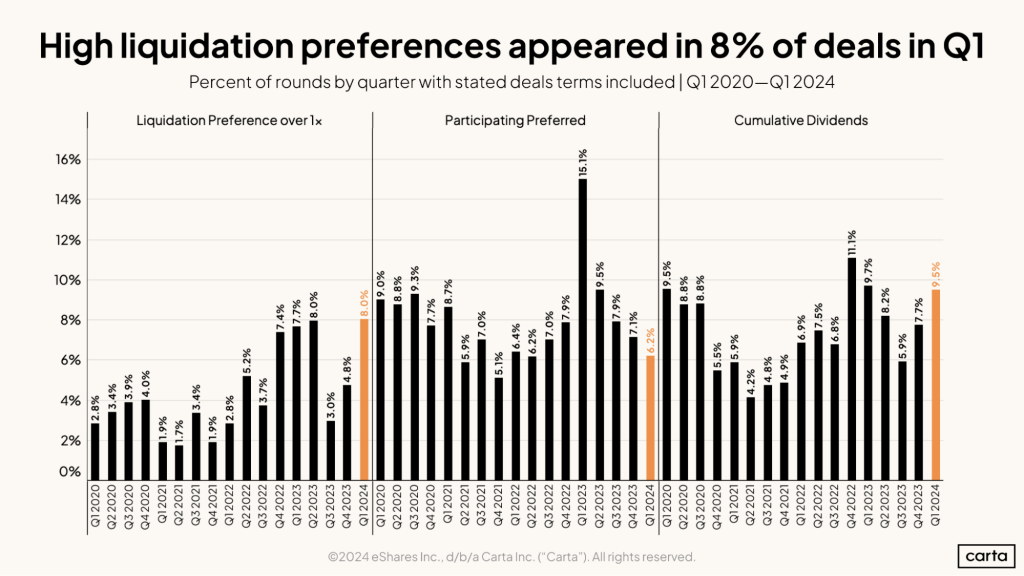

There are other non-standard terms that offer preferred shareholders extra protection. These non-standard terms often become more prevalent within difficult funding environments as companies are forced to offer more downside protections to investors.

- A liquidation multiplier term allows investors to receive a “multiple” of their liquidation preference before converting their preferred shares into common shares.

- Cumulative dividends are dividends that accumulate over time regardless of whether they are declared by the board. However, cumulative dividends are usually only paid when the board declares them. Typically, they accrue from the shares’ issue date until the company’s exit. Any accrued dividends are added to the investor’s liquidation preference upon a company’s exit.

- Non-standard conversion ratios could be something other than one-to-one. Investors can convert preferred shares into common shares at a reduced price, enabling them to gain a larger share of the company’s future payouts.

As we can see from the above chart, following the end of the pandemic bull market in 2022, the leverage in the venture capital market shifted towards investors. Consequently, it became more common for new VC funding rounds to incorporate deal terms designed to protect investors from downside risk or to secure additional upside.

Liquidation Scenarios:

- An IPO generally increases liquidity for all equity holders: In most cases, all preferred shares will be converted into common shares at a predetermined rate. The IPO provides an opportunity for both common and preferred shares to realize the market value of shares. However, there is often a lock-up period (typically 6-12 months) before some shares can be sold.

- The process during an acquisition is slightly more complex: When a private company has a liquidity event, such as being acquired in an M&A transaction, shareholders are typically paid out in what is termed a liquidation waterfall, where preferred and common shares are paid out according to the terms of their liquidity preference. As mentioned above, preferred shares can come with rights and terms that can lead to significant downside for common shareholders, which puts them at risk of receiving little to no payout, particularly if the company is sold at less than its original value.

Capital stack risk takes on more significance when the private company stock is sourced via the secondary market. The shares in the secondary market are typically common or early-stage preferred and have less downside protection because they are often sourced from early stock issued to employees and other early investors. It should be noted that a vast majority of new funding rounds still don’t include these types of structures, however it is an important factor to be aware of given the current funding climate.

This memorandum is for educational purposes only and does not constitute investment advice or represent how InvestX Capital Ltd. or any of its affiliates make decisions with respect to any investment vehicles.

Recent Posts

- Market Update, June 2025: IPO Activity Reaccelerates – Implications from CoreWeave, Circle, and Chime 06th Jun 2025

- Private Markets Review – Q1, 2025 14th Apr 2025

- xAI and X.com Merger: InvestX Analysis 10th Apr 2025